By Neil Patrick

If you live in the UK or USA and have bought a new car in the last few years, there is a 90% likelihood you paid for it with some form of car finance arrangement. Car sales have boomed due to the low monthly costs of PCP or personal contract purchase agreements.

I’ve been watching the explosion of this market with close interest. And I am now convinced this form of finance is set to implode, or at least be regulated out of existence. But this isn't the whole story. This situation has worrying parallels with the sub-prime mortgages which sparked the 2008 crash and subsequent recession.

As US car finance debt smashed through the one trillion dollar mark earlier this year, my worries seemed justified:

If your work has anything to do with vehicle sales, your career and financial outlook is set to become less rosy as this story unfolds.

When debt bubbles inflate, sooner or later (usually later) regulators step in and clamp down. In the UK, the Bank of England are monitoring things closely they say. The Financial Services Authority (FSA) has announced it will investigate PCPs, but has promised no report on its findings until next year. Both these facts are revealing. Clearly, financial regulators believe things are going wrong. But as they also believe these failures pose no major threat to the financial stability of the nation’s economy, they are not treating it as high priority.

I think they are wrong. Not because of the risk within this market itself, but because it could be the flash point for a much larger confidence collapse in wider consumer credit markets. Or what central bankers call 'contagion'.

So if you have bought a car using a PCP contract, there seems to be no reason to be worried about your car loan. But this mounting debt does create a much wider risk to financial stability. And this story has a disturbingly large number of parallels with with the sub-prime mortgage crisis which triggered the 2008 collapse.

Over the coming months and years, used car values will take a severe correction as the excessive volume of recently bought cars reach their contract expiry and come onto the second hand market. When this happens (as it inevitably will), I think it likely that there will be new regulations in force making PCP deals much harder to obtain and much more expensive.

The makings of a new financial crisis are in place. It could even be worse than 2007-8, for the simple reason that the Federal Reserve and The Bank of England have not yet restored their balance sheets to their pre-2008 levels.

To understand what is happening, here are ten reasons why I believe this story will have an unhappy ending for the auto industry even if the contagion risk doesn't actually materialise. And one why it might lead to a better outcome for car buyers…

1. There is a glut of unsold cars and cheap money

The car industry is beset with problems. Even before the vehicle emissions testing scandal, many of the world’s biggest car brands have been battling depressed share prices, insolvency and bankruptcy. Throughout the recession, global vehicle production hardly faltered, while most people’s incomes shrank. Result - all over the planet there are hundreds of square miles of land containing thousands upon thousands of unsold cars.

This is a Google Earth view of one such just a few miles from me:

Meanwhile, central banks have been keeping interest rates at record low levels desperately trying to stimulate our comatose economies back into life. They want businesses to borrow to invest in their future growth. Instead what is happening is businesses are remaining cautious about borrowing and consumers are racking up debt as their pay grows little or not at all.

2. Low monthly repayments not increasing incomes are increasing car sales

I first began to think something was wrong when I started noticing shiny new cars everywhere I went. In a booming economy, that would be normal. But our economy hasn’t been booming for 10 years. People’s incomes are static or falling and basic costs of living such as food and energy have been rising. This just didn’t make sense.

The answer was not too hard to find. I just started looking at car finance deals being advertised. Like this:

A shiny new Audi TT for less than £300 a month. A traditional car hire purchase agreement for this car would cost around £850 a month if financed over 3 years.

The clever bit here (although doubtless, those involved call it ‘innovative’) is that unlike a traditional HP loan, with a PCP, you never actually own the vehicle (unless you stump up many thousands of pounds or dollars at the end of the contract). You just pay the depreciation (and a deposit) AND a big balloon payment if you want to buy the car at the end of the contract.

For many people, this isn’t an issue. Who cares if you own or rent your car? But that’s not the real issue. Most people need to have a car for daily use. And most people take the path of least resistance when dealing with their financial affairs. So at the end of their contract, most will take out a new and quite possibly bigger one. It’s the best lock-in and exploitation of consumer inertia I have ever seen.

3. Car makers are celebrating a record sales year in 2016 but…

U.S. auto sales are now crashing: It’s broadly acknowledged that U.S. auto sales have peaked after a record year in 2016. But even this ‘record’ is an illusion; Americans had to be enticed to buy with discounts of over $4,000 per vehicle on average, shaving 10% of the typical asking price and depressing margins for car makers. Lately, even discounts can’t stop this downward spiral - April marked the fourth consecutive month of declines in U.S. vehicle sales - with Ford posting an ugly 7.1% decline.

Meanwhile, forget all the nonsense about how disruptors like Tesla Inc. is worth “more” than Ford based on market capitalization. The reality is Tesla trades for roughly 6 times sales – and you can’t even calculate its P/E because it doesn’t have a single penny in earnings this year and isn’t expected to be profitable in 2018 either.

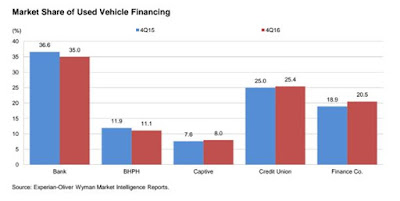

4. Banks are withdrawing from car finance, but new firms are charging into the void:

This is a typical scenario in a financial sector when large institutions perceive increasing risk. They edge out of the riskiest parts of the market. In their place, smaller and less cautious firms move in to take up the slack. And in the last two years this is exactly what we can see happening:

5. Credit and affordability checks are too loose

Car finance underwriting is much looser than mortgage underwriting. The applications are completed by car dealer staff who frankly don’t care if you can afford the payments or not. If you believe all car salesman tell the truth, then good luck with that. The simple truth is that when the seller of finance is not the provider of that money, there will always be people erm, let’s say, stretching the truth in order to make the sale.

6. Consumers do not understand what they are buying

Finance is boring and complex to understand for many people. And when all they care about is getting their hands on that shiny new car, all rational sense can disappear. If I learned one thing after 20 years in the finance industry, it was that there’s only one number 99% of customers care about. It is simply ‘how much will this cost each month?’

This is perhaps the best example ever of blind ignorance – and it is skilfully exploited by finance providers with invisible collusion with car sales men and women. It’s only if we drill down into the detail that it becomes clear that even with a low monthly repayment, driving a brand new car is a very expensive way of getting about. Depreciation is the biggest cost component of new car ownership and if you borrow the money to pay for just the depreciation, you are not just losing the depreciation, you are also

paying interest on that depreciation for the privilege.

7. Loan portfolios are being securitised

Whilst some PCPs are provided by in-house manufacturer finance divisions, these are not growing their participation. A whole new sector of firms have sprung up to take advantage of this booming market.

This is a big problem for the simple reason that they have no money of their own to lend. In order to lend it to you, they must obtain this money by buying it on the wholesale money markets. And the cost they must pay for this depends on the market’s appetite for lending. Thanks to massive QE over recent years, right now, the markets are awash with funds and so money is both cheap and plentiful. This money oversupply means inevitably that it gets treated less cautiously than when times are tight.

But there is a bigger issue which has worrying echoes of what happened with subprime mortgages in 2007-8. PCPs, just like sub-prime mortgages are being bundled up and sold on to institutional investors. Sensible car loans and risky ones are being bundled up together and sold. For the originators of these loans (the finance firms), this is a neat way to get the risk off their balance sheet and their income flows turbocharged. But this is also what I believe will ultimately crash the market. Because the moment confidence is dented in the quality of these loan portfolios, there will be panic and a rush for the exits. And we are already on the path to this because:

8. There are rising default levels on these loans

Losses at auto lenders, particularly those specializing in lending to subprime borrowers are reaching a level not seen since 2008. Ford Motor Credit, has already warned in its most recent outlook that “we continue to see credit losses increase.”

This will inevitably lead to tightening auto credit for consumers, as these losses begin to exact their pound of flesh from the lenders.

Some specialized subprime lenders will keel over. Larger lenders with good quality loan portfolios will bleed but survive by tightening their underwriting standards in order to weather the storm. And that’s precisely what the auto industry is dreading: tightening credit.

The auto boom over the past few years has been funded by all-time record low interest rates and loose underwriting, with long loan terms and high loan-to-value ratios, often over 120%. They made everything possible. But they also infused the $1.1 trillion in auto loans with some very big risks.

9. Loans are being sold by unqualified and highly incentivised car salesmen

Car sales people don’t get paid much money, unless they sell a lot of cars. But dealer margins have been eroded so much that car salespeople now earn most of their pay from the sale of finance not cars. The days when being a cash buyer had salesmen bending over backwards for your custom are long gone. Selling cars is nothing like selling finance, but when your pay check depends primarily on how many car

loans you sell, it’s easy to guess what happens. In the UK, car salespeople selling finance have to be registered and take a test to ‘ensure’ they know what they are talking about. But the reality is that these tests are taken online and so easily cheated that such qualifications and checks, mean almost nothing.

10. Regulators are doing too little, too late, too slowly

The announcement recently by the FSA in the UK that they were going to investigate the PCP market made headlines, but will soon be forgotten by the mainstream media until the findings are released (some time next year). Meanwhile the party will continue at car dealerships the length and breadth of the US and the UK until the whole thing ends with a whimper or a bang ( I confess I’m currently unsure which).

Meanwhile the defaults on these loans are growing and the bubble is getting ever more unsustainable with subprime auto loans now being about three times more than they were just five years ago:

And finally - there is some good news for consumers coming I think

So for car dealers and consumers too, these are quite probably the last days of the party. But there is a hidden bonus for car buyers coming I think. As this all plays out and we see some bankruptcies amongst lenders, a tightening of underwriting, reduced PCP availability and falling used car values, we will see some real bargains on dealer forecourts. Buying a newish car and paying for it with cash or a more conventional loan will be more affordable than ever. Just not

crazy cheap, thankfully.That or 2008 all over again.